How Estate Planning Attorney can Save You Time, Stress, and Money.

Table of ContentsThe Buzz on Estate Planning AttorneyEstate Planning Attorney Can Be Fun For AnyoneEstate Planning Attorney Can Be Fun For EveryoneEstate Planning Attorney Can Be Fun For Anyone

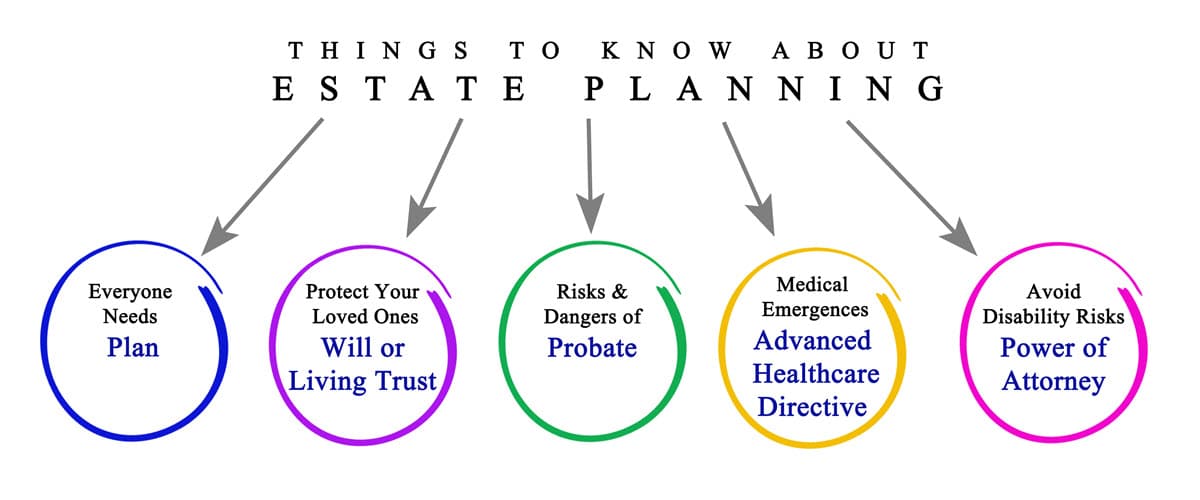

Estate planning is an action strategy you can make use of to establish what happens to your properties and commitments while you live and after you die. A will, on the other hand, is a lawful record that describes exactly how properties are dispersed, that looks after youngsters and animals, and any kind of other wishes after you pass away.

Cases that are declined by the administrator can be taken to court where a probate judge will have the final say as to whether or not the insurance claim is valid.

The Of Estate Planning Attorney

After the stock of the estate has actually been taken, the value of possessions determined, and tax obligations and financial obligation paid off, the administrator will then seek authorization from the court to disperse whatever is left of the estate to the recipients. Any estate tax obligations that are pending will come due within nine months of the day of fatality.

Each specific locations their properties in the count on and names somebody aside from their partner as the recipient. Nonetheless, A-B trusts have become much less prominent as the estate tax exemption works well for many estates. Grandparents may transfer assets to an entity, such as a 529 plan, to sustain grandchildrens' education.

Top Guidelines Of Estate Planning Attorney

Estate coordinators can collaborate with the benefactor in order to minimize taxable revenue as an outcome of those payments or develop methods that maximize the impact of those contributions. This is an additional approach that can be used to limit fatality tax obligations. It entails a private securing the existing value, and therefore tax obligation obligation, of their home, while attributing the value of future growth of that resources to another individual. This approach includes cold the value of a property at its value on the date of transfer. Appropriately, the quantity of possible capital gain at death is also iced up, enabling the estate coordinator to estimate their possible tax responsibility upon death and far better plan for the repayment of revenue taxes.

If adequate insurance policy profits are readily available and the plans are appropriately structured, any kind of earnings tax obligation on the regarded dispositions of properties following the fatality of an individual can be paid without resorting to the sale of possessions. Profits from life insurance policy that are obtained by the beneficiaries upon the fatality of the insured are typically earnings tax-free.

Other costs connected with estate preparation include the prep work of a will, which can be as low as a couple of hundred dollars if you use among the finest online will certainly makers. There are specific papers you'll need as part of the estate preparation process - Estate Planning Attorney. Several of one of the most usual ones consist of wills, visit this website powers of attorney (POAs), guardianship classifications, and living wills.

There is a myth that estate planning is just for high-net-worth people. Yet that's not true. Actually, estate planning is a device that everyone can go to this web-site utilize. Estate planning makes it easier for people to identify their wishes before and after they die. Contrary to what a lot of individuals believe, it prolongs beyond what to do with properties and obligations.

Estate Planning Attorney Things To Know Before You Buy

You should begin preparing for your estate as soon as you have any kind of measurable possession base. It's an ongoing procedure: as life advances, your estate plan need to shift to match your situations, in line with your brand-new goals.

Estate planning is usually assumed of as a tool for the affluent. Yet that isn't the instance. It can be a useful way for you to manage your properties and liabilities prior to and after you die. Estate planning is additionally a great means for you to set out plans for the care of your small youngsters and pets and to detail your long for click for more your funeral service and favorite charities.

Qualified applicants that pass the examination will be officially accredited in August. If you're eligible to rest for the exam from a previous application, you may file the brief application.